Financial reports and presentations are essential tools for businesses, lenders, advisors, investors, and even everyday consumers. In 2026, with financial transparency more important than ever, Americans rely on well-designed reports and clear presentations to understand performance, make decisions, and build trust.

This guide breaks down how to create strong financial reports, which formats are most effective, what investors and clients expect, and how to deliver presentations that simplify even the most complex financial data.

🔹 1. Why Financial Reporting Matters in 2026

Financial reports allow businesses and individuals to:

- Track revenue, expenses, and profit

- Identify financial strengths & weaknesses

- Show transparency to investors and lenders

- Support tax filing

- Prepare for audits

- Communicate performance clearly

The better the report, the easier it is to make strong financial decisions.

🔹 2. Types of Financial Reports Used in the United States

Here are the most important reports used by businesses, lenders, and financial professionals.

✔ Income Statement (Profit & Loss Statement)

Shows:

- Revenue

- Operating expenses

- Net profit

Used for:

- Loans

- Taxes

- Investor updates

- Performance tracking

✔ Balance Sheet

A snapshot of:

- Total assets

- Total liabilities

- Equity

Crucial for lenders evaluating business stability.

✔ Cash Flow Statement

Breaks down:

- Operating cash flow

- Investing cash flow

- Financing cash flow

Shows if a business can survive month-to-month.

✔ Budget Reports

Track:

- Planned spending

- Actual spending

- Financial variances

Useful for both families and businesses.

✔ Loan or Debt Reports

Includes:

- Loan balance

- Payment history

- Interest paid

- Remaining term

Lenders require this for refinancing or reviews.

✔ Annual Reports

Used by:

- Corporations

- Nonprofits

- Government agencies

Includes:

- Financial summary

- Charts & visuals

- Executive insights

🔹 3. What Makes a Good Financial Report? (U.S. Standards)

To make reports clear, transparent, and useful:

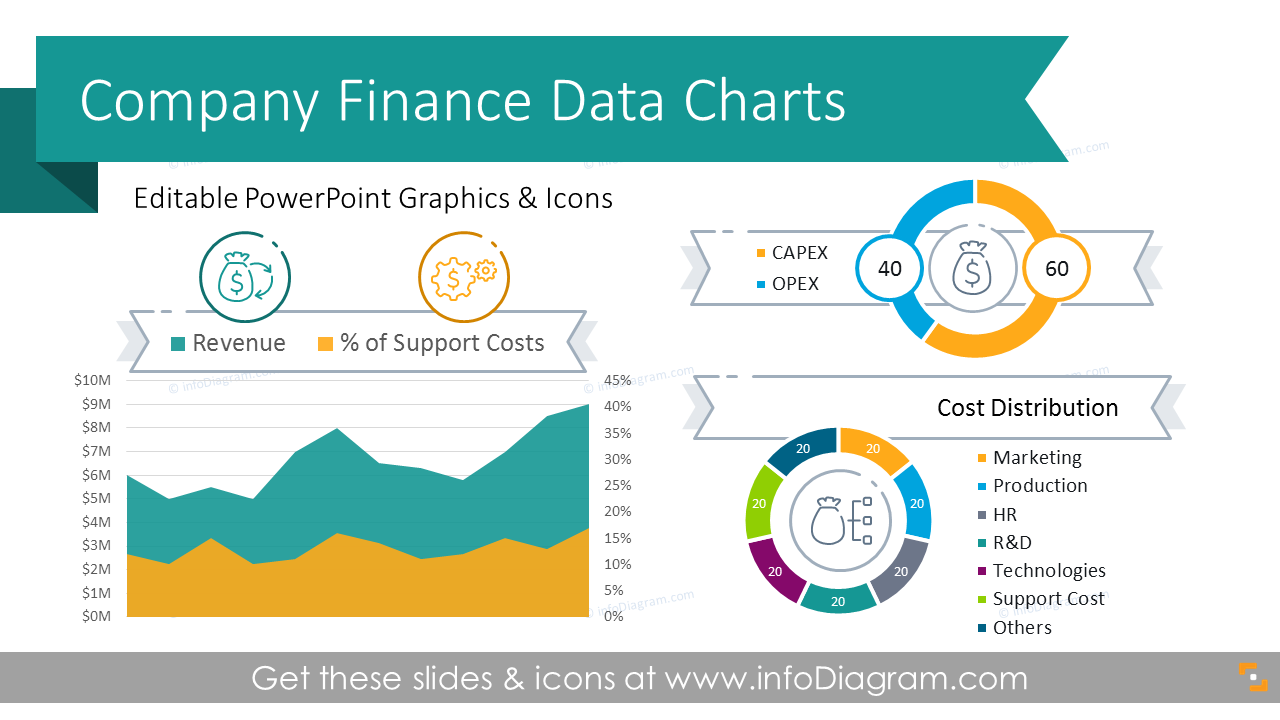

✔ Use simple visualizations

- Bar charts

- Line graphs

- Pie charts

- Tables with clear labels

✔ Focus on insights

Don’t just show numbers – explain what they mean.

✔ Keep formatting consistent

- Same fonts

- Same colors

- Same spacing

- Standard U.S. date format (MM/DD/YYYY)

✔ Use clean, readable language

Avoid technical jargon.

✔ Always include a summary

Decision-makers appreciate quick conclusions.

✔ Make reports downloadable

PDF, XLSX, and CSV formats are preferred in the U.S.

🔹 4. Financial Presentation Guide: How to Present Data Clearly

A great presentation turns complex financial data into simple, actionable insights.

Best Practices for Financial Presentations

- Stick to 10–12 slides

- Use big, bold headings

- Limit each slide to one main point

- Replace paragraphs with graphs & visuals

- Use bullet points for key insights

- Maintain brand consistency

- Use contrasting colors for clarity

Essential Slides

- Overview

- Key metrics

- Revenue trends

- Expense breakdown

- Profit analysis

- Projections

- Risks & opportunities

- Recommendations

Best Tools

- PowerPoint

- Google Slides

- Canva

- Keynote

- Notion

🔹 5. Common Mistakes to Avoid in Financial Reporting & Presenting

❌ Overloading slides with numbers

✔ Use visuals instead.

❌ Using inconsistent terms or formats

✔ Stick to templates.

❌ Making reports too long

✔ Summaries and visuals are more effective.

❌ No clear conclusion

✔ Always end with action steps or next recommendations.

🔹 6. How Small Businesses Benefit from Strong Reporting

Strong financial reporting helps U.S. small businesses:

- Get approved for loans

- Attract investors

- Track monthly performance

- Avoid cash flow issues

- Prepare taxes accurately

Clear reporting = better opportunities.

🔹 7. How Consumers Benefit From Financial Reports

Consumers use reports to:

- Track spending

- Manage debt

- Understand interest costs

- Plan savings

- Prepare tax documents

Financial literacy starts with clear data.

⭐ Conclusion

Financial reports and well-designed presentations are essential tools in 2026. They improve transparency, help businesses grow, and empower individuals to make informed decisions.

Clear, consistent financial communication builds trust – whether you’re reporting to clients, investors, lenders, or internal teams.