In 2026, American financial businesses-from lenders and credit repair agencies to tax professionals and fintech startups-depend on two core pillars to build trust:

- Strong client account systems & membership services

- Clear, transparent financial reporting & presentations

Customers are more cautious than ever with their personal data and financial decisions. They expect seamless account access, transparent reporting, and a professional digital experience.

This guide explains how U.S. finance companies can create powerful client account systems AND deliver high-quality financial presentations that boost trust, retention, and long-term loyalty.

🔹 1. Why Client Accounts & Membership Services Matter in Finance

Financial services require precision, privacy, and transparency.

A well-designed client account portal makes customers feel:

- Safe

- In control

- Informed

- Confident

What U.S. clients expect in 2026:

- A secure login dashboard

- Easy access to loan documents

- Real-time application status

- Payment history & statements

- Updates and alerts

- Ability to upload documents

- 24/7 access through mobile or desktop

A good account portal is not a luxury anymore — it’s a requirement.

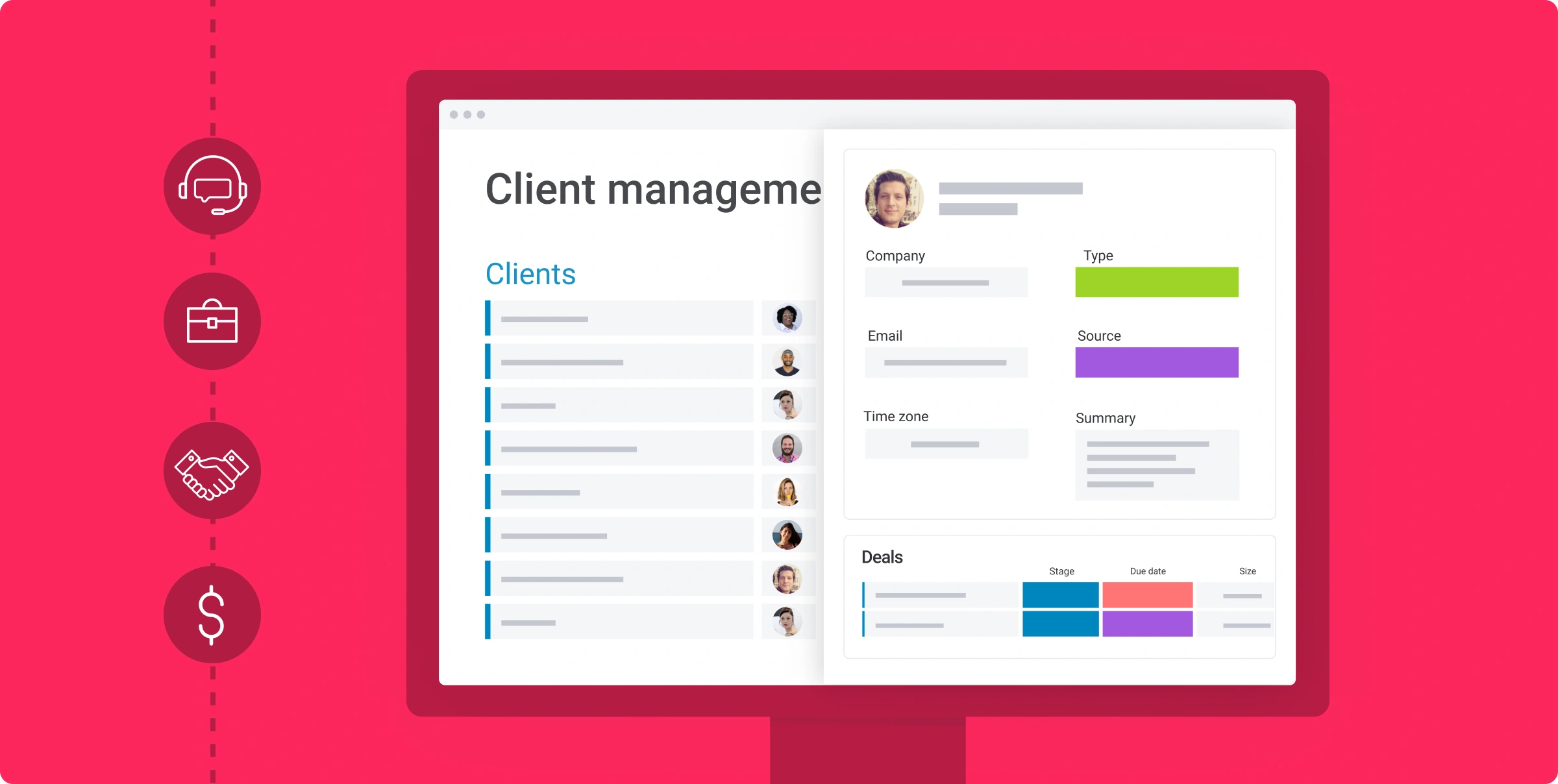

🔹 2. Features of a High-Quality Client Account Portal

✔ 1. Secure Login System

- MFA (two-factor authentication)

- Encrypted connections (HTTPS)

- Fraud-detection tools

✔ 2. Transparent Loan & Account Overview

Clients should see:

- Loan balance

- Payment schedules

- Due dates

- Interest breakdown

- Transaction history

✔ 3. Instant Document Access

- Agreements

- Statements

- Tax forms

- Compliance documents

✔ 4. Real-Time Alerts

- Due payments

- Approved applications

- Updated loan rates

- Suspicious activity

✔ 5. Mobile-Friendly Interface

Most Americans check accounts from smartphones.

🔹 3. Membership Services: The New Growth Model in U.S. Finance

Membership-based models are booming in the finance sector.

Examples of financial memberships:

- Credit monitoring memberships

- Premium financial coaching

- Exclusive loan discounts

- Investment groups

- Tax assistance memberships

- Financial literacy subscriptions

Why memberships help finance businesses

- Stable recurring revenue

- Higher customer retention

- Increased trust and loyalty

- Better long-term customer relationships

Americans value “member benefits,” especially in financial services.

🔹 4. Financial Reporting: The Core of Transparency

Every financial business must provide accurate reports to:

- Clients

- Investors

- Auditors

- Employees

- Stakeholders

Good reporting improves:

- Trust

- Clarity

- Decision-making

- Professional reputation

Poor reporting creates confusion — and in finance, confusion destroys trust.

🔹 5. How to Create Professional Financial Reports (U.S. Standards)

✔ Keep reports simple

Use:

- Line charts

- Bar graphs

- Clean tables

- Highlighted key numbers

✔ Include “Key Takeaways”

People rarely read entire reports – summaries help.

✔ Maintain consistent formatting

- Same fonts

- Same headings

- Same date format

- Same color palette

✔ Use understandable language

Avoid:

❌ “Variable amortization structures…”

Use:

✔ “Your monthly payment will change based on…”

✔ Provide downloadable formats

- Excel

- CSV

Clients should be able to save reports for future use.

🔹 6. Presentation Guides for Financial Businesses

Financial presentations are necessary for:

- Client onboarding

- Loan program explanations

- Investor meetings

- Business pitches

- Monthly performance updates

What makes a strong financial presentation?

- Clean, professional slides

- Minimal text

- Visual charts

- Simple flow

- Powerful examples

- Strong CTA at the end

✔ Key Slide Ideas

- “Who We Are”

- “Services & Membership Benefits”

- “Client Account Features”

- “Financial Performance Overview”

- “Growth Roadmap”

- “Next Steps”

The goal: Make complex financial information simple.

🔹 7. Combining Client Accounts + Great Reporting = Maximum Trust

When a financial business offers:

✔ a secure account system

✔ transparent reporting

✔ clear presentations

✔ strong membership benefits

…it creates the perfect customer experience.

Results you can expect:

- Higher conversion rates

- More long-term clients

- Increased referrals

- Better online reputation

- Higher customer satisfaction

Trust is the foundation of finance – your systems help build it.

⭐ Conclusion

Client accounts, membership services, and financial presentations form the backbone of modern financial businesses in the United States.

When combined, they create a smooth, transparent, and trustworthy experience that clients love.

In 2026 and beyond, financial companies that invest in these systems will outperform competitors and build stronger, more loyal customer relationships.