In 2026, American consumers expect more than just access to financial services. They want trustworthy brands, secure digital experiences, and personalized membership-style benefits. Whether you operate a lending firm, fintech platform, credit repair company, tax service, investment agency, or mortgage business, a strong brand combined with a modern client account system is the key to long-term success.

This guide explains how branding shapes perception, how client accounts enhance customer experience, and how membership services strengthen loyalty in the U.S. financial market.

🔹 1. Why Branding Matters for Financial Businesses in 2026

In the United States, financial services are highly competitive. Customers must share sensitive information – income, credit data, identification – so they will only work with a business that looks legitimate and trustworthy.

Strong branding signals:

- Professionalism

- Stability

- Security

- Transparency

- Expertise

- Credibility

What branding influences:

- Loan application volume

- Customer trust levels

- Online reviews

- Client retention

- Conversion rates

In finance, branding is not design – it’s reputation.

🔹 2. Key Branding Elements Every Financial Company Needs

✔ Professional Logo & Color Palette

Finance brands typically use:

- Blue → trust, reliability

- Green → money, growth

- Gray/White → clarity, professionalism

- Black → premium authority

✔ Clear & Transparent Messaging

Avoid jargon.

Communicate simply:

- What services do you offer

- Who qualifies

- What are the costs?

- How customers benefit

✔ High-Trust Website Experience

A financial website must:

- Load fast

- Look modern

- Be mobile-friendly

- Use security badges

- Offer simple navigation

Trust begins the moment a customer lands on your site.

✔ Social Proof

Show:

- Reviews

- Testimonials

- Case studies

- BBB accreditation

- Licensing details

Transparency builds confidence.

🔹 3. Client Account Systems: The Core of Modern Financial Operations

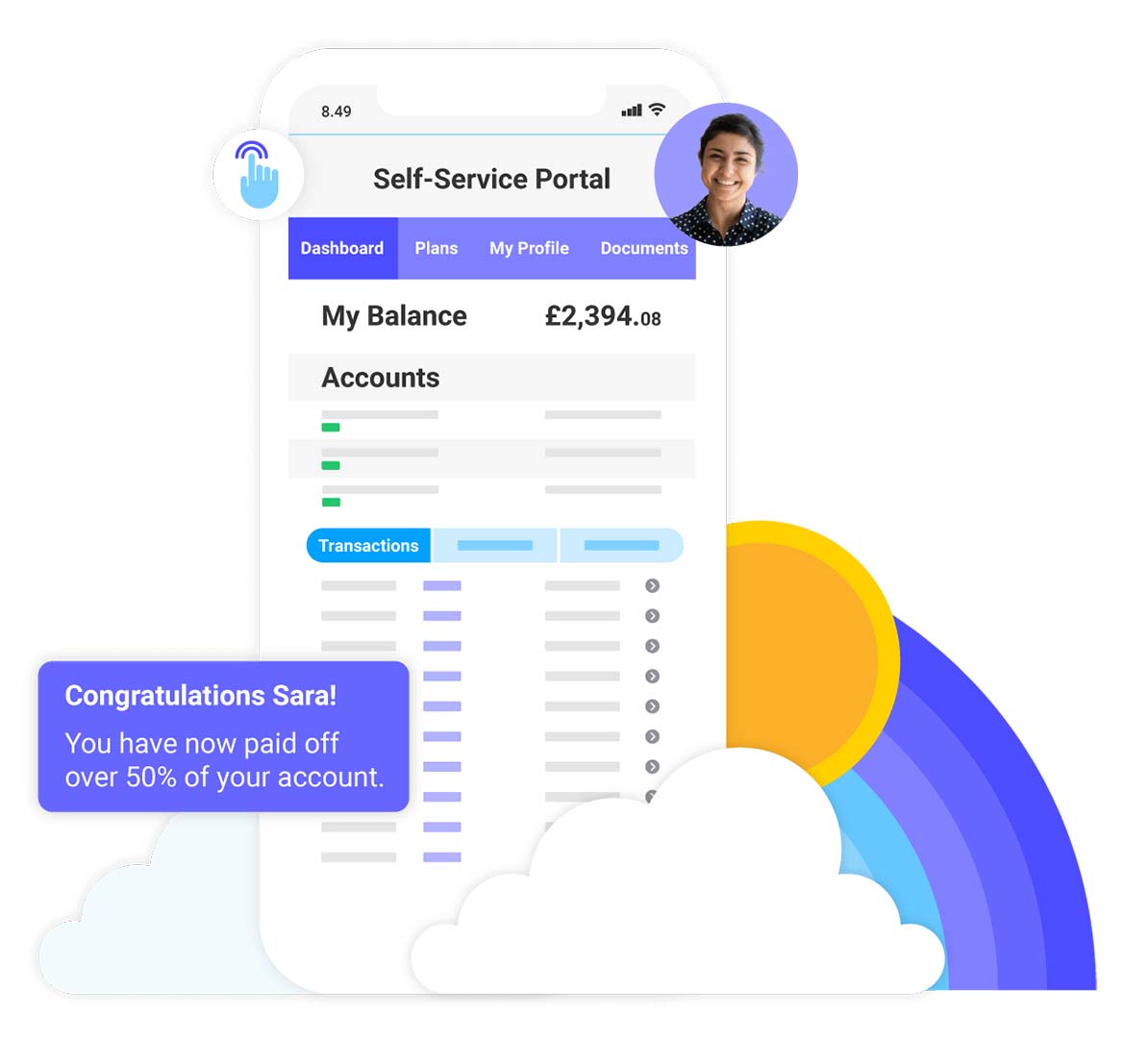

Once branding attracts a customer, the client account system keeps them engaged.

Financial companies in 2026 must offer simple, secure, self-service digital dashboards that give customers real-time access to their financial information.

Features Customers Expect in a Modern Client Account Portal

✔ 1. Secure Login (2FA/MFA)

Security is a top priority in the U.S.

Customers expect:

- Two-factor authentication

- Encrypted connections

- Fraud detection

✔ 2. Real-Time Account Overview

Clients must instantly see:

- Loan balances

- Payment schedules

- Interest rates

- Transaction history

- Alerts & updates

✔ 3. Document Management

Borrowers should be able to:

- Upload documents

- Download agreements

- View disclosures

- Access tax forms

This reduces support inquiries.

✔ 4. Payment Tools

A strong portal includes:

- Auto-pay setup

- Instant payments

- Multiple payment methods

- Payment reminders

✔ 5. Secure Messaging

Allows customers to communicate privately with support teams.

✔ 6. Mobile-Friendly Design

Nearly 70% of Americans manage finances on mobile devices.

🔹 4. Membership Services: The Future of Financial Loyalty Programs

Financial businesses increasingly use membership services to provide value beyond the basic loan or service.

Popular membership benefits include:

- Lower interest rates for members

- Loyalty-based APR discounts

- Early access to funds

- Financial coaching sessions

- Credit monitoring tools

- Identity theft protection

- Budgeting tools

- Priority customer support

Membership services make the customer feel valued and supported – not just processed.

🔹 5. How Branding + Client Accounts + Membership Services Work Together

These three pillars complement each other and create a complete, trust-building ecosystem.

✔ Branding builds trust at first sight

A polished, professional brand makes clients feel safe.

✔ Client Accounts create transparency

A customer who sees their information clearly is more confident and less anxious.

✔ Membership Services build long-term loyalty

Additional benefits make clients stay and engage with your company longer.

Combined Benefits for Financial Companies:

- Higher retention rates

- Better customer satisfaction

- Stronger client relationships

- Improved online reviews

- Higher lifetime customer value

- More referrals

- Lower support costs

This trio is the foundation of modern financial success.

🔹 6. Best Tools for Branding & Client Account Integration

✔ Branding Tools

- Canva

- Adobe Illustrator

- Looka (logo creation)

✔ Client Account Portals

- Salesforce Financial Services Cloud

- HubSpot CRM

- Custom fintech dashboards

- Secure document management systems

✔ Membership Tools

- Stripe Billing

- Memberstack

- Custom API integrations

Modern tools help automate onboarding, payments, notifications, and user dashboards.

⭐ Conclusion

Branding attracts customers.

Client accounts keep customers engaged.

Membership services keep customers loyal.

In 2026, financial businesses that combine all three will stand out in the U.S. market, earn customer trust faster, and build long-term success.

Trust + Transparency + Value = A winning financial brand.