Financial planning in the United States is becoming increasingly digital. Whether an American is applying for a loan, budgeting for a home, running a small business, or preparing taxes, finance tools, calculators, and professional document templates are now essential for accuracy and efficiency.

This guide breaks down the most useful financial calculators, the best digital finance tools, and the most important document templates for both businesses and individuals in 2026.

🔹 1. Why Financial Tools & Templates Are Essential Today

The U.S. financial landscape is complex – interest rates shift, loan requirements change, and tax rules vary each year.

Finance tools and standardized templates help:

- Save time

- Reduce calculation errors

- Improve decision-making

- Ensure compliance

- Provide professional documentation

- Help users understand financial outcomes before committing

They turn complicated financial decisions into simple, clear steps.

🔹 2. Most Important Financial Calculators for Americans (2026)

Below are the calculators most commonly used by Americans for loans, budgeting, and financial planning.

✔ 1. Loan Payment Calculator (Personal, Auto, Installment)

Shows:

- Monthly payment

- Total cost of the loan

- Total interest over time

Useful for comparing lenders during the pre-approval process.

✔ 2. Mortgage Calculator

Includes:

- Principal + interest

- Property taxes

- Homeowners insurance

- PMI

- 15-year vs 30-year loan comparisons

Essential for homebuyers analyzing affordability.

✔ 3. Refinance Calculator

Helps determine:

- New payment amount

- Interest savings

- Break-even point

Americans often use this before refinancing their mortgage.

✔ 4. Debt-to-Income (DTI) Ratio Calculator

Lenders use DTI to evaluate borrower risk.

This tool checks if a borrower qualifies for:

- Mortgages

- Auto loans

- Personal loans

✔ 5. Credit Card Payoff Calculator

Shows:

- How long does it take to pay off debt

- Interest paid over time

- Effect of adding extra monthly payments

Perfect for debt-reduction planning.

✔ 6. Business Cash Flow Calculators

Used by:

- Small businesses

- Startups

- Freelancers

Helps track income, expenses, and future cash shortages.

🔹 3. Best Digital Finance Tools in the U.S. (2026)

✔ Accounting Software

- QuickBooks

- FreshBooks

- Xero

✔ Budgeting Tools

- YNAB (You Need A Budget)

- Mint

- EveryDollar

✔ Tax Tools

- TurboTax

- H&R Block

- TaxAct

✔ Investment Tools

- Fidelity

- Robinhood

- Schwab

- M1 Finance

✔ Loan Comparison Tools

- Credit Karma

- NerdWallet

- Bankrate

These tools help users make confident financial decisions quickly.

🔹 4. Essential Financial Templates for Professionals & Consumers

Professional document templates save time and ensure legal compliance.

The most commonly used templates include:

✔ Loan Agreement Template

Includes:

- Borrower & lender info

- APR disclosure

- Payment schedule

- Terms & legal clauses

Used by lenders, investors, and individuals.

✔ Invoice & Billing Template

For freelancers, businesses, and service providers.

Must include:

- Itemized services

- Payment terms

- Tax details

- Due dates

✔ Profit & Loss (P&L) Statement Template

Required for:

- Business loans

- Tax filing

- Investor reports

Shows revenue, expenses & net income.

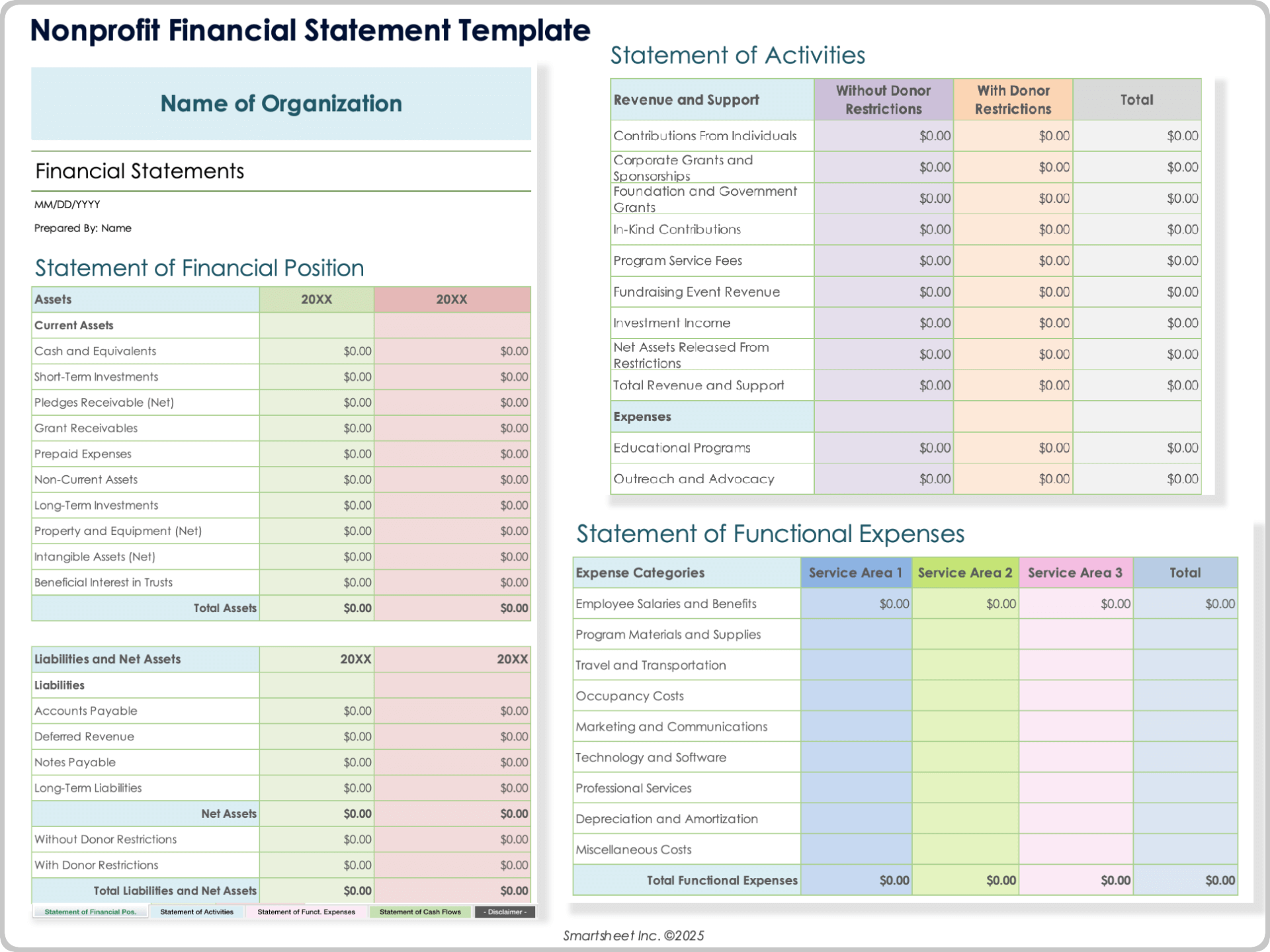

✔ Balance Sheet Template

Displays:

- Assets

- Liabilities

- Equity

Helpful for lenders evaluating business financial health.

✔ Budget Planner Template

Used by both households and businesses.

✔ Tax Preparation Templates

Includes:

- Expense logs

- Deduction organizer

- 1099 earnings tracker

✔ Financial Report Template

Great for:

- Annual reports

- Investor updates

- Business performance summaries

🔹 5. How to Design Clean, Professional Financial Documents

Even simple documents must look professional in the financial industry.

✔ Use Clean Layouts

- Clear headings

- Wide spacing

- Organized tables

✔ Choose Professional Fonts

Examples:

- Calibri

- Arial

- Helvetica

- Roboto

✔ Keep Branding Consistent

Add:

- Company logo

- Color theme

- Contact details

- Footer with disclaimers

✔ Include Legal Disclosures

Especially for loan forms:

- APR

- Fees

- Terms & conditions

✔ Provide Multiple File Types

- Word

- Excel

This makes templates accessible for all types of users.

🔹 6. Tools for Designing & Editing Financial Templates

✔ Microsoft Excel – best for formulas

✔ Google Sheets – best for collaboration

✔ Canva – best for polished document design

✔ Microsoft Word – best for agreements

✔ Adobe Acrobat – best for fillable PDF forms

Choosing the right tool saves hours of formatting.

🔹 7. Why Finance Tools + Templates Create Better Outcomes

When Americans combine calculators with professional templates, they gain:

- Clear financial understanding

- Better loan decisions

- More accurate budgeting

- Time-saving workflow

- Professional communication

- Improved compliance

- Stronger financial confidence

It’s the perfect combination of technology + organization.

⭐ Conclusion

Finance tools, calculators, and document templates are essential resources in 2026. They help Americans make smarter decisions, prepare accurate documents, and understand financial outcomes before taking action.

From loan planning to budgeting and business reporting, these tools make every financial task easier – and more professional