In today’s fast-paced financial world, Americans rely on digital tools, calculators, and ready-made financial templates more than ever. Whether you’re applying for a loan, running a business, planning taxes, or comparing mortgage rates, the right tools can save time, prevent errors, and improve financial decision-making.

This guide explains the top financial calculators, business tools, and document templates that U.S. users need in 2026 – plus how to design clean, compliant financial documents for professional use.

🔹 1. Why Finance Tools & Templates Matter?

Financial decisions in the United States are becoming more complex due to rising interest rates, changing regulations, and new digital platforms.

Tools and templates help by providing:

- Accuracy

- Speed

- Compliance

- Professional presentation

- Easy comparison of financial data

From loan estimates to business budgets, digital tools help Americans make smarter financial choices.

🔹 2. Essential Finance Calculators Every American Should Use

These tools help individuals and businesses calculate financial scenarios instantly.

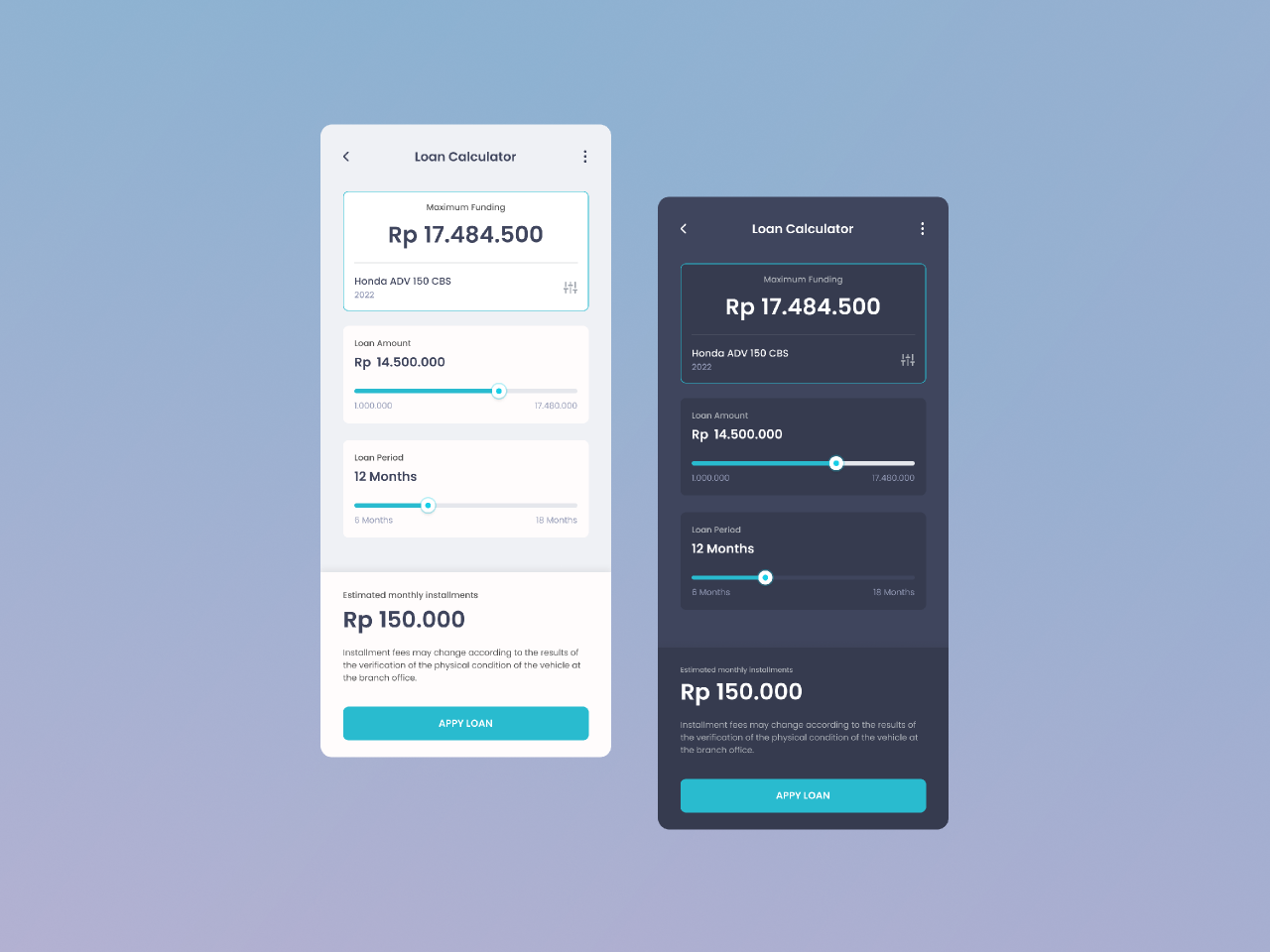

✔ 1. Loan Calculator (Auto, Personal, Installment)

Shows:

- Monthly payments

- Total interest

- Amortization schedule

- APR impact

Perfect for borrowers comparing multiple lenders.

✔ 2. Mortgage Calculator

Includes:

- Principal

- Interest rate

- PMI

- Taxes & insurance

- Loan term

Homebuyers rely heavily on these tools before applying.

✔ 3. Refinance Calculator

Helps U.S. homeowners decide if refinancing will:

- Lower their monthly payment

- Save them money long-term

- Reduce or increase total interest

✔ 4. Debt-to-Income (DTI) Ratio Calculator

Essential for:

- Mortgage approval

- Personal loan qualification

- Budget planning

Lenders use DTI to measure risk.

✔ 5. Credit Card Interest Calculator

Shows:

- Payoff timeline

- Total interest paid

- Impact of minimum payments

Helps consumers manage debt smarter.

✔ 6. Business Budget & Cash Flow Calculator

Critical for:

- Small businesses

- Startups

- Freelancers

Cash flow tools help companies stay profitable.

🔹 3. Best Financial Tools for U.S. Businesses

✔ Accounting Tools

- QuickBooks

- Xero

- FreshBooks

✔ Invoice & Payment Tools

- Square Invoicing

- Stripe Billing

- PayPal Business

✔ Tax Tools

- TurboTax

- H&R Block

- TaxAct

✔ Investment Tools

- Robinhood

- Fidelity

- Charles Schwab

- M1 Finance

Digital tools reduce errors and streamline workflow.

🔹 4. Financial Templates: The Backbone of Professional Finance Work

Templates save hours of work for financial companies, accountants, loan officers, consultants, and individuals.

Common financial templates include:

- Loan agreements

- Income statements

- Balance sheets

- Business plans

- Profit & loss (P&L) statements

- Budget sheets

- Invoice templates

- Payment schedules

- Tax documents

- Financial disclosures

Templates ensure clarity, accuracy, and legal compliance.

🔹 5. How to Design Clean, Professional Financial Documents

Document design matters more than people think – especially in finance.

✔ Use a clean layout

- Clear headings

- Proper spacing

- Organized sections

- Easy-to-read fonts (Arial, Helvetica, Calibri)

✔ Include all required legal disclaimers

Financial documents must:

- Disclose fees

- Show APR clearly

- List repayment terms

- Follow federal compliance rules

✔ Use consistent branding

- Same color palette

- Logo placement

- Professional tone

✔ Add digital signature boxes

Most U.S. clients prefer e-signature over printing.

✔ Provide templates in multiple formats

- PDF (official)

- Word (editable)

- Excel (calculations)

A well-designed document increases trust and reduces confusion.

🔹 6. Tools for Creating Financial Templates & Reports

✔ Microsoft Excel

Best for formulas and financial modeling.

✔ Google Sheets

Great for sharing real-time calculations.

✔ Canva

Useful for branded templates.

✔ Notion

Great for interactive finance dashboards.

✔ Adobe Acrobat

For secure, fillable PDF forms.

🔹 7. Combining Tools + Templates = Smarter Financial Decisions

Using calculators + ready-made templates gives Americans:

- Better financial visibility

- More accurate planning

- Faster loan preparation

- Lower margin of error

- Professional-level financial organization

This combination is essential for:

- Loan applications

- Mortgage decisions

- Small business planning

- Credit management

- Tax preparation

In 2026, financial tools aren’t optional – they are necessary.

⭐ Conclusion

Finance tools, calculators, and document templates empower U.S. consumers and businesses to make smarter, faster, and clearer financial decisions. Whether it’s analyzing loan payments, preparing tax forms, or designing professional reports, these resources create structure and accuracy in every financial workflow.

A strong financial setup starts with the right tools – and the right templates.